Semiconductor Industry Inventory Normalizes; UBS Top Picks Include Texas Instruments, Renesas Electronics, and Infineon

Zhitong Caijing APP learned that UBS released its latest research report, based on evidence from its lab monitoring inventory and pricing data from over 100 global distributors, indicating that current semiconductor industry inventory and pricing trends are generally positive. In particular, the continued digestion of MCU inventory has alleviated market concerns about supply-demand imbalances. The report suggests that while trade tensions and tariff risks may have dampened further inventory reduction momentum, the industry is gradually moving toward supply-demand equilibrium. UBS remains bullish on Texas Instruments (TXN.US), Renesas Electronics (RNECY.US), and Infineon (IFNNY.US).

1. Core Trends: Steady Inventory Adjustment with Stable-to-Rising Pricing

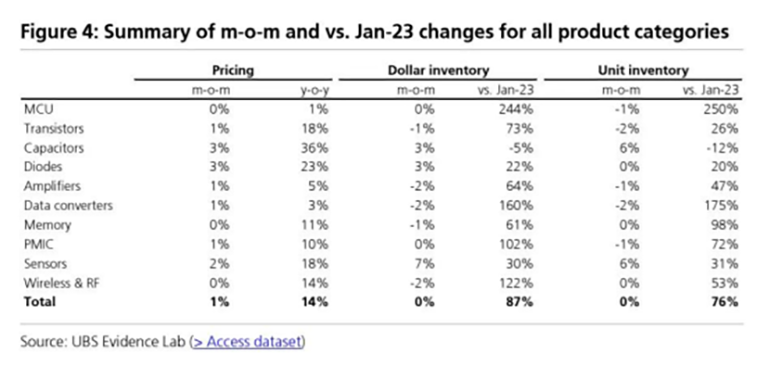

The report notes that global semiconductor inventory in July showed a stable adjustment trend. Except for capacitors and sensors, which saw a 6% month-on-month (MoM) increase in inventory, other categories either remained flat or declined by 2%. Notably, MCU inventory has been digesting since February, with a 1% MoM drop this month—slower than the 5% decline last month—but still continuing the destocking trend.

On pricing, the average across all categories rose 1% MoM, with a 14% year-on-year (YoY) increase (attributed mainly to product mix adjustments by UBS). Specifically, transistor prices rose 1% MoM, surging 18% YoY, driven primarily by bipolar transistors. Capacitors, diodes, and sensors saw price increases of 2%-3% MoM, while other categories remained flat or rose 1% MoM, reflecting an overall stable pricing environment.

Figure 1

2. Key Product Segment Dynamics

MCUs: Standardized unit inventory declined for the third consecutive month, down 1% MoM, with prices flat MoM but up 1% YoY. Subcategory prices remained stable or saw slight increases. Although current inventory levels remain higher than in January 2023, UBS emphasizes that the category was in severe shortage at the beginning of 2023.

Transistors: Inventory fell 2% MoM, while prices rose 1% MoM (compared to a 2% MoM increase last month), with YoY growth expanding to 18%.

Passive Components: Multilayer ceramic capacitor (MLCC) inventory rose 2% MoM by the end of June and increased another 5% in July. Capacitor prices surged 36% YoY and rose 3% MoM, while inventory fell 12% YoY.

Sensors: Prices rose 18% YoY and 2% MoM, driven mainly by magnetic sensors. Inventory grew 31% YoY and 6% MoM, showing significant fluctuations in recent months.

3. Corporate-Level Observations

Based on a corporate heatmap analysis, weighted average pricing in July rose 3% YoY (the same as in May). Overall inventory remained stable, with MCU destocking slowing. Previously, this trend was driven mainly by Microchip Technology (MCHP.US) and STMicroelectronics (STM.US), while Infineon's MCU inventory share rose from a historical average of 2.6% to 4%, showing signs of inventory accumulation.

As an officially certified third-party partner of Renesas, Weathink can provide additional technical and productization support for Renesas processors. We recommend using Weathink -designed RZ/G2L SOM, such as the WTC-G2LS SOM.